Explore the future of Anduril Industries stock, a leader in defense innovation. Discover its cutting-edge technologies, financial milestones, and private investment opportunities, including details on accessing secondary markets.

Product Offerings: Anduril offers cutting-edge defense solutions, including the AI-powered Lattice platform, Ghost 4 drones, Altius UAVs, Anvil combat drones, and Dive-LD underwater vehicles.

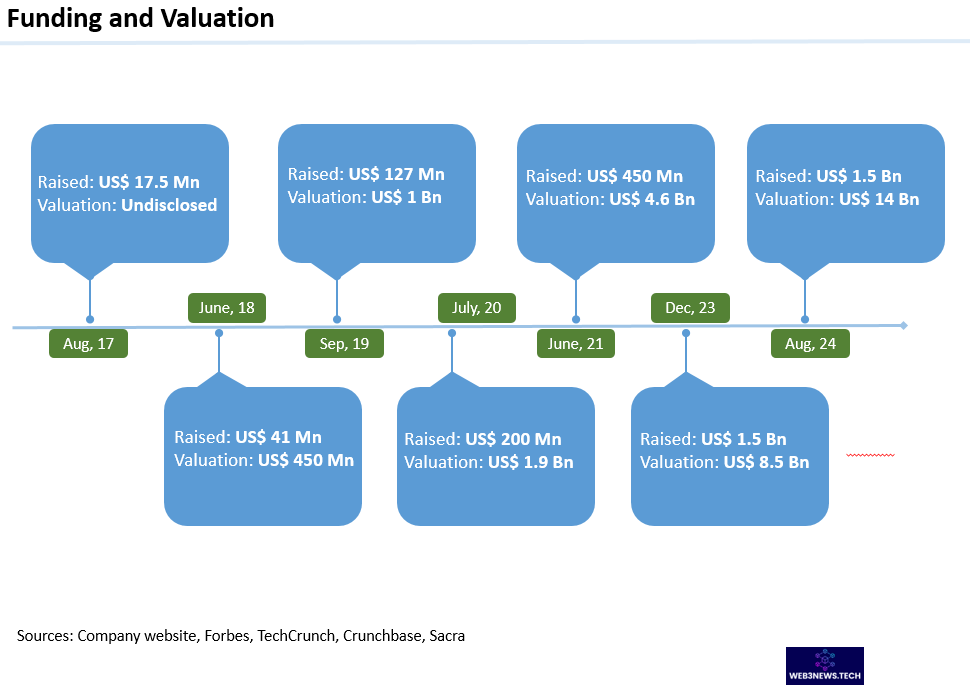

Funding: Anduril Industries has raised over $3.8 billion across multiple funding rounds, achieving a $14 billion valuation by 2024. Its investors include top venture firms like Founders Fund and Valor Equity Partners.

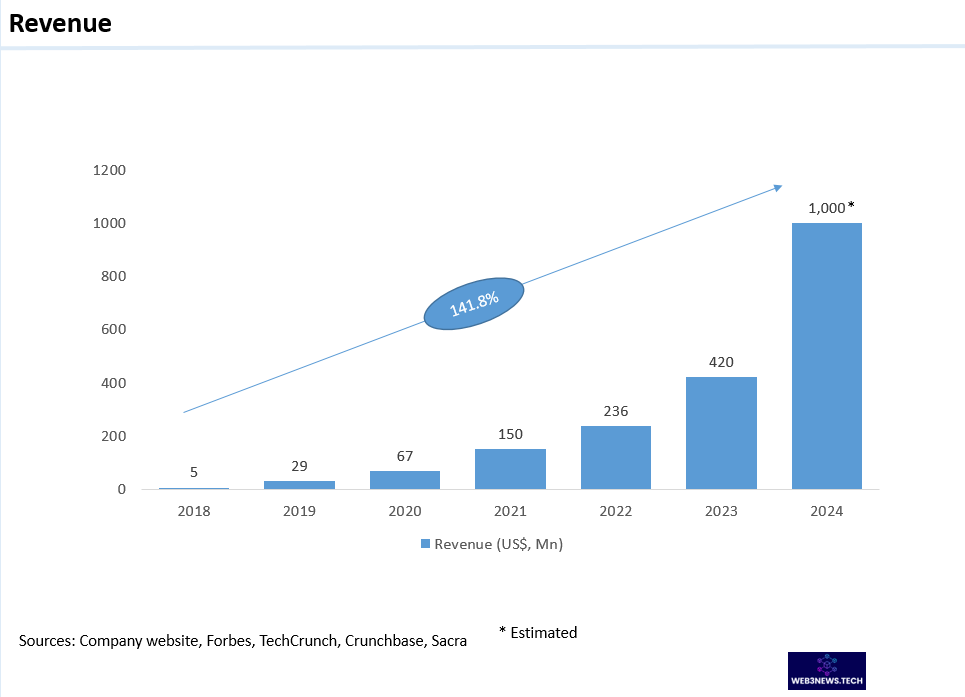

Revenue: Anduril’s revenue growth has been exponential, increasing from $5 million in 2018 to an estimated $1 billion in 2024, reflecting a compound annual growth rate of over 140%.

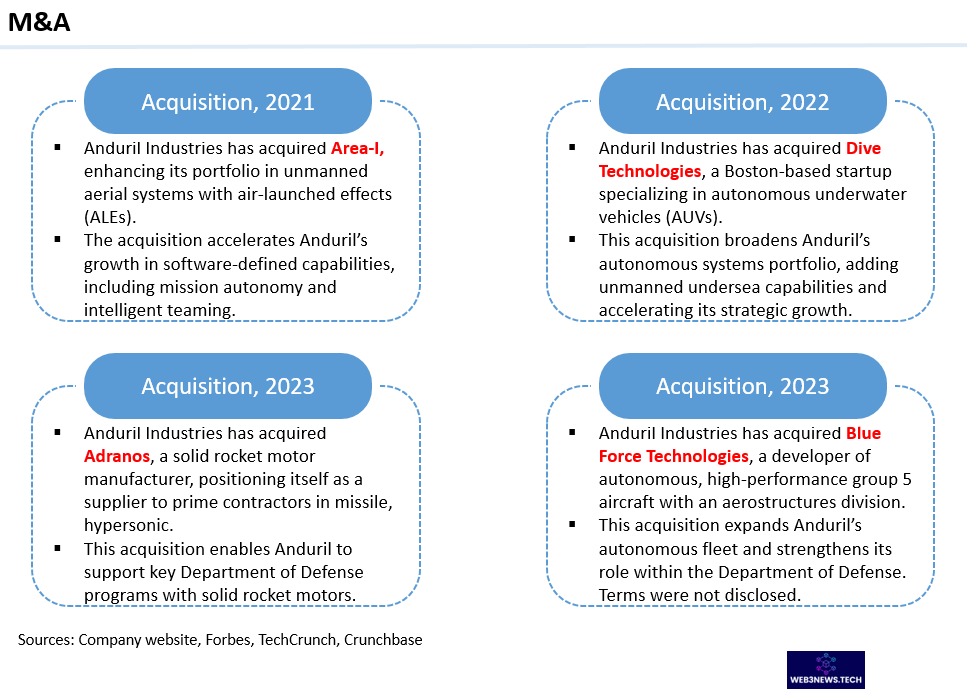

Acquisitions: The company has expanded its capabilities through strategic acquisitions like Dive Technologies for underwater operations and Adranos Energetics for advanced propulsion systems.

Recent Developments: Anduril has partnered with governments worldwide, including Taiwan and Australia, to deliver autonomous defense solutions while exploring AI-driven satellite mobility with Impulse Space.

Table of Contents

Introduction: Why Anduril Industries Is a Game-Changer

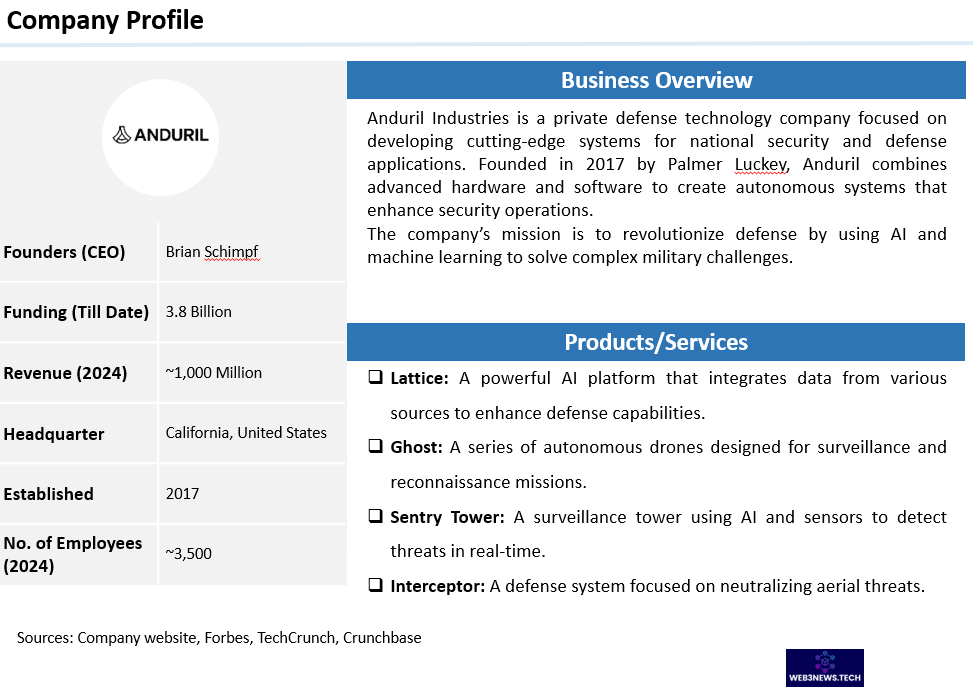

Founded in 2017 by Palmer Luckey, Anduril Industries is reshaping the defense landscape with autonomous systems and advanced artificial intelligence (AI). Combining innovation with operational efficiency, Anduril has positioned itself as a key player in modern warfare technology.

While Anduril Industries stock isn’t currently traded on public markets, the company’s trajectory suggests that it’s a matter of when—not if—an IPO happens. This article will provide a thorough look at the company, its financial performance, product offerings, and how investors can gain exposure to its stock through private markets.

What Is Anduril Industries?

Anduril Industries operates at the forefront of the defense technology sector, developing solutions that enhance situational awareness and operational capabilities for military forces worldwide.

The company collaborates with governments and defense organizations to tackle critical security challenges, leveraging the power of AI and robotics.

Core Product Offerings: Revolutionizing Defense Systems

Anduril’s product line is designed to meet the demands of modern warfare by integrating AI, automation, and advanced engineering.

- Lattice Platform: The flagship AI-driven platform that powers Anduril’s autonomous systems. Lattice integrates data from multiple sources to create a comprehensive, real-time operational picture, improving decision-making and efficiency.

- Ghost 4: A small unmanned aerial system (sUAS) used for intelligence, surveillance, and reconnaissance (ISR) missions. Ghost 4 can operate autonomously, reducing the need for human oversight.

- Altius Series: Modular unmanned aerial vehicles (UAVs) capable of advanced networked operations. The Altius 600 model is highly sought after for its versatility and payload capacity.

- Anvil: An unmanned combat aerial vehicle (UCAV) that specializes in intercepting and neutralizing enemy drones with precision targeting.

- Dive-LD: An autonomous underwater vehicle that expands maritime operational capabilities, from coastal monitoring to deep-sea exploration.

These offerings highlight Anduril’s commitment to staying at the cutting edge of defense technology.

Financial Highlights: Funding and Revenue Growth

Funding Success

Anduril has raised substantial funds to fuel its growth, attracting investments from premier venture capital firms like Founders Fund and Valor Equity Partners.

With over $2 billion raised across multiple rounds, Anduril’s valuation reached $14 billion by 2024, signaling strong investor confidence.

Impressive Revenue Growth

Anduril’s revenue growth trajectory underscores its ability to deliver on market demands. From just $5 million in 2018, revenues are projected to hit $1 billion by the end of 2024.

This exponential growth, driven by increasing adoption of its technology, positions Anduril as a dominant player in the defense market.

Strategic Growth Through Mergers and Acquisitions

To maintain its competitive edge, Anduril has pursued strategic acquisitions to enhance its product offerings and technological capabilities.

- Area I (2021): Bolstered UAV capabilities with the Altius drone series.

- Dive Technologies (2022): Expanded into underwater systems with the Dive-LD vehicle.

- Adranos Energetics (2023): Strengthened propulsion system technology.

These acquisitions not only diversify Anduril’s portfolio but also enhance its ability to meet the evolving needs of defense agencies.

Competitive Landscape: Anduril vs. Peers

The defense technology sector is fiercely competitive, with innovation at the core of success. Anduril faces competition from companies such as:

- Rebellion Defense: A software-focused defense company specializing in national security applications.

- Shield AI: Known for autonomous aircraft and drone technologies.

- Second Front Systems: Offers SaaS platforms tailored for defense operations.

Despite this competition, Anduril’s emphasis on autonomous solutions and AI integration sets it apart, giving it a technological and operational advantage.

Recent Developments: Staying Ahead of the Curve

Anduril consistently innovates to address the complex needs of modern defense.

- U.S. Army Collaboration: Partnered with Microsoft to enhance Integrated Visual Augmentation Systems (IVAS) for soldiers.

- Taiwan Defense Deal: Signed an agreement to deliver 1,000 attack drones, bolstering Taiwan’s defenses against regional threats.

- Australian Air Force Contract: Secured a three-year agreement to provide autonomous security solutions.

- Impulse Space Collaboration: Developing AI-driven satellite mobility technologies for orbital maneuvers.

These initiatives solidify Anduril’s reputation as a forward-thinking leader in defense technology.

How to Invest in Anduril Industries Stock

Private Investment Options

Currently, Anduril Industries stock is unavailable for public trading. However, there are pathways to invest privately, provided you meet certain criteria.

- Direct Investment: Anduril occasionally offers shares during private funding rounds.

- Secondary Markets: Platforms like Nasdaq Private Market allow accredited investors to purchase shares in private companies.

Also Read: Cerebras Systems IPO Date: What You Need to Know

Exploring Nasdaq Private Market

Nasdaq Private Market caters to institutional investors, offering a platform for trading private stocks. To invest in Anduril through this platform:

- Meet Institutional Investor Criteria: Ensure you qualify as an accredited or institutional investor.

- Access Tape D™ Database: Explore private market opportunities, including Anduril stock, through Nasdaq’s proprietary database.

While these avenues provide opportunities to invest in Anduril, private stock transactions often involve risks like limited liquidity and restricted access to company information.

Conclusion: A Bright Future for Anduril Industries

Anduril Industries represents a new era of defense technology, blending AI and autonomy to address pressing global security challenges. Its innovative products, strong financial performance, and strategic partnerships underline its potential as a long-term investment opportunity.

While Anduril Industries stock is not yet publicly traded, accredited investors can access shares through private markets like Nasdaq Private Market. For those eyeing the defense technology sector, Anduril offers an exciting opportunity to align with a company shaping the future of military innovation.

Keep an eye on Anduril’s developments and potential IPO announcements as it continues to grow and redefine the defense landscape.

Is Anduril Industries Stock publicly traded?

No, Anduril Industries is a privately held company and does not trade on public exchanges

Can individuals buy Anduril Industries stock?

Yes, but only through private markets or funding rounds. Accredited investors can explore options via Nasdaq Private Market or similar platforms.

What is Anduril’s valuation?

Anduril is valued at $14 billion as of 2024.

Will Anduril Industries Stock go public?

There’s no official announcement, but industry speculation suggests a potential IPO in the near future.

How can I invest in Anduril Industries stock?

Accredited investors can invest through private stock transactions facilitated by platforms like Nasdaq Private Market.

Why is Anduril Industries stock attractive?

Anduril’s innovative product offerings, exponential revenue growth, and robust market positioning make it a compelling opportunity for investors interested in defense technology.