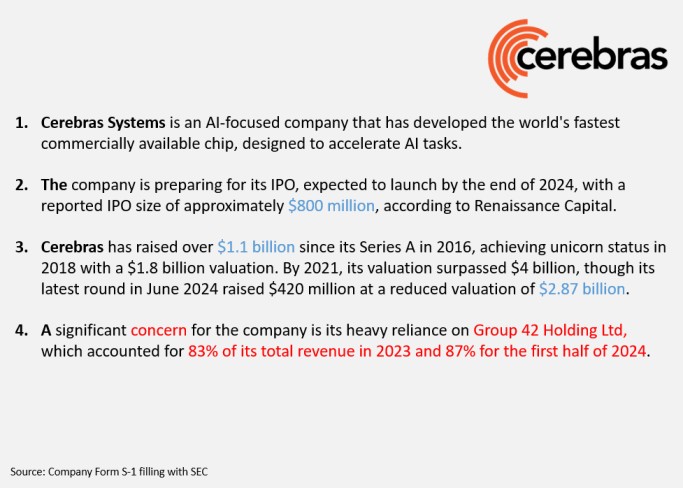

As the world of artificial intelligence (AI) continues to grow and revolutionize industries, AI companies like Cerebras Systems are stepping into the spotlight. Cerebras Systems, a cutting-edge AI company, has recently announced plans for its much-anticipated Initial Public Offering (IPO).

With growing interest around the Cerebras Systems IPO date, this event is expected to attract significant attention from investors looking to capitalize on the explosive growth of AI technologies. In this article, we will dive into Cerebras Systems’ background, its product offerings, details about the Cerebras Systems IPO date, and financials, along with an analysis of risks and competition in the AI sector.

Table of Contents

About Cerebras Systems

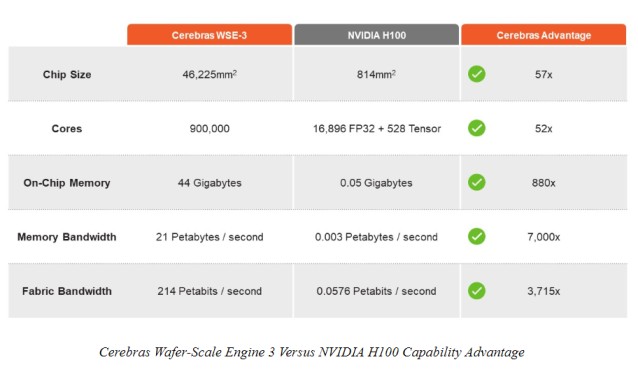

Cerebras Systems is a leader in the AI hardware and software space. Founded in 2016, the company has designed one of the fastest and largest AI chips in the world, known as the Wafer-Scale Engine (WSE). While many competitors have focused on GPUs (Graphics Processing Units), Cerebras chose to take a different path by developing AI-specific processors that are optimized for machine learning and artificial intelligence workloads.

The company doesn’t stop at chip design. It has also developed a full suite of AI systems and software that complement its hardware. These systems are designed to provide the power, cooling, and data integration required to feed the WSE, creating a cohesive platform capable of supporting some of the most demanding AI tasks in existence.

Cerebras Systems Offerings

- AI Compute Systems: Cerebras integrates its chips into complete systems that include processors, cooling solutions, and data management systems. These systems are designed to reduce the time and complexity involved in training and deploying AI models.

- AI Software: Cerebras also offers software that allows these systems to integrate with common machine learning frameworks like PyTorch, enabling customers to use their supercomputers without having to learn new tools or programming languages.

Cloud and On-Premise Solutions: Customers can access Cerebras’ AI systems either via cloud platforms or by deploying them on-premises. This flexibility makes their products accessible to a wide variety of industries, from academic research to large-scale enterprise applications.

Cerebras Systems IPO Details

The most exciting news surrounding Cerebras Systems is its upcoming IPO, which is expected to hit the market by the end of 2024. The Cerebras Systems IPO date has not yet been finalized, but it is widely anticipated to be a major event in the tech world.

According to Renaissance Capital, the IPO is expected to raise $800 million, giving investors a significant opportunity to buy into a rapidly growing AI company. Cerebras has already raised over $1.1 billion in funding across several rounds, including a recent $420 million Series F-1 round in June 2024.

However, this round came at a lower valuation of $2.87 billion, compared to its previous peak valuation of over $4 billion. This signals a cautious environment but also highlights the massive growth potential of the company.

Company Financials

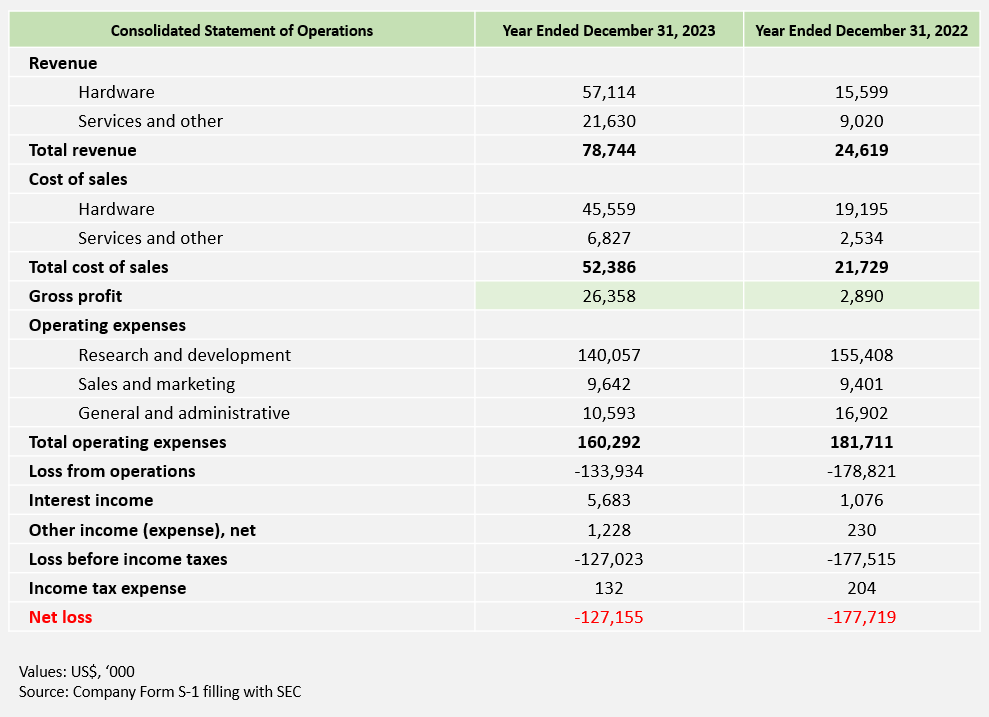

Cerebras has shown tremendous growth in recent years. Their total revenue jumped from $24.6 million in 2022 to $78.7 million in 2023, representing a year-over-year growth of 220%. During the first six months of 2024, the company generated $136.4 million in revenue, significantly outpacing the prior year’s figures.

Despite this impressive revenue growth, the company has not yet reached profitability. In 2023, Cerebras reported a net loss of $127.2 million, an improvement over the previous year’s loss of $177.7 million. By mid-2024, the company had reduced its losses even further, posting a $66.6 million loss in the first half of the year, down from $77.8 million the year prior.

The company’s financials show significant growth potential, but also highlight the challenges Cerebras faces in achieving profitability in a highly competitive market. Investors interested in the Cerebras Systems IPO date should consider these financials carefully when evaluating the potential of the company.

Competition

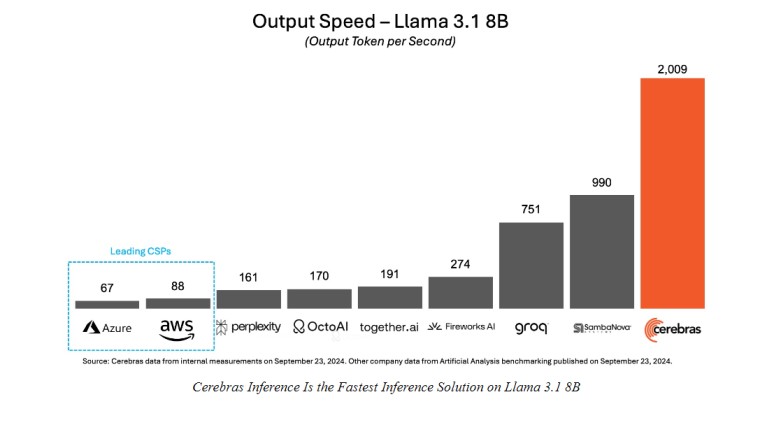

Cerebras operates in an increasingly competitive landscape, where tech giants such as Nvidia, Advanced Micro Devices (AMD), and Intel dominate. Nvidia, in particular, holds a leading position in the AI hardware market due to its widely adopted GPU technology. Cerebras, however, differentiates itself with its focus on wafer-scale integration, a novel approach that offers performance benefits for specific AI workloads.

Other competitors include Microsoft and Alphabet, which have developed their own AI technologies and hardware solutions. Smaller private companies, some of which specialize in inference-only technologies, are also vying for market share. Cerebras will need to continue innovating to maintain its competitive edge, but its unique hardware and strategic partnerships, like those with G42, position it well for the future.

TAM Analysis (Total Addressable Market)

Cerebras is tapping into a massive and growing AI market. As AI adoption continues to accelerate, enterprises, research organizations, and governments are all looking for solutions to improve efficiency and stay competitive.

According to Bloomberg Intelligence research, the Total Addressable Market (TAM) for AI training infrastructure is expected to be around $72 billion in 2024, growing to $192 billion by 2027 at a compound annual growth rate (CAGR) of 39%.

The TAM for AI inference is even more promising, growing from $43 billion in 2024 to $186 billion by 2027, at a staggering CAGR of 63%. This growth offers Cerebras enormous potential for capturing market share as it continues to scale its AI compute platforms.

Risks

As exciting as the Cerebras Systems IPO date might be, there are several risks that potential investors should be aware of:

- Customer Concentration: A significant portion of Cerebras’ revenue comes from Group 42 Holding Ltd (G42), a technology company based in Abu Dhabi. G42 accounted for 83% of Cerebras’ total revenue in 2023, making the company highly dependent on this single customer. A reduction in demand from G42, or any disruption in their business relationship, could severely impact Cerebras’ financial performance.

- Competition: As mentioned earlier, Cerebras faces tough competition from well-established players like Nvidia, AMD, and Intel. These companies have larger financial resources and a broader customer base. Cerebras will need to continue innovating and differentiating its products to remain competitive.

- Financial Losses: While Cerebras has seen impressive revenue growth, the company is not yet profitable. Ongoing losses could be a concern for potential investors, particularly if Cerebras is unable to achieve profitability in the near future.

- Operational Challenges: As the company scales rapidly, managing this growth efficiently will be a challenge. The company’s headcount has grown significantly, and failure to streamline operations could lead to inefficiencies.

Also Read: Open AI Stock Investment Opportunities: What You Need to Know

Conclusion

Cerebras Systems is an innovative player in the AI industry, and its upcoming IPO presents an exciting opportunity for investors looking to tap into the growing demand for AI technologies.

With its groundbreaking Wafer-Scale Engine, strong revenue growth, and large Total Addressable Market, Cerebras is well-positioned to continue its growth trajectory. However, the company’s reliance on a small number of customers, including G42, and its ongoing financial losses present notable risks.

Investors interested in the Cerebras Systems IPO date should consider the company’s growth potential alongside these risks before making any investment decisions.

FAQs

What is Cerebras Systems?

Cerebras Systems is an AI hardware and software company that designs and manufactures the world’s largest AI chip, the Wafer-Scale Engine (WSE). The company provides AI compute systems, software, and cloud/on-premise solutions for training and inference tasks.

When is the Cerebras Systems IPO date?

The Cerebras Systems IPO date is expected by the end of 2024, though the exact date has not yet been confirmed.

How much is Cerebras looking to raise from the IPO?

Cerebras Systems is projected to raise around $800 million in its IPO, according to Renaissance Capital.

What will be the Cerebras Systems stock symbol?

Cerebras Systems will trade on the Nasdaq under the ticker symbol “CBRS” after its IPO.

What is the Cerebras Systems stock price?

The stock price for Cerebras Systems will be determined during the IPO process, which has not yet been finalized. Investors should stay tuned for updates as the IPO date approaches.

Who are Cerebras’ main competitors?

Cerebras faces competition from major technology companies like Nvidia, AMD, Intel, Microsoft, and Alphabet, in addition to various private companies specializing in AI computing.

What are the main risks associated with investing in Cerebras?

Key risks include customer concentration (with G42 accounting for the majority of its revenue), competition from larger, more established companies, and the fact that Cerebras is still operating at a financial loss.

1 thought on “Cerebras Systems IPO Date: What You Need to Know”